The ERIG Index

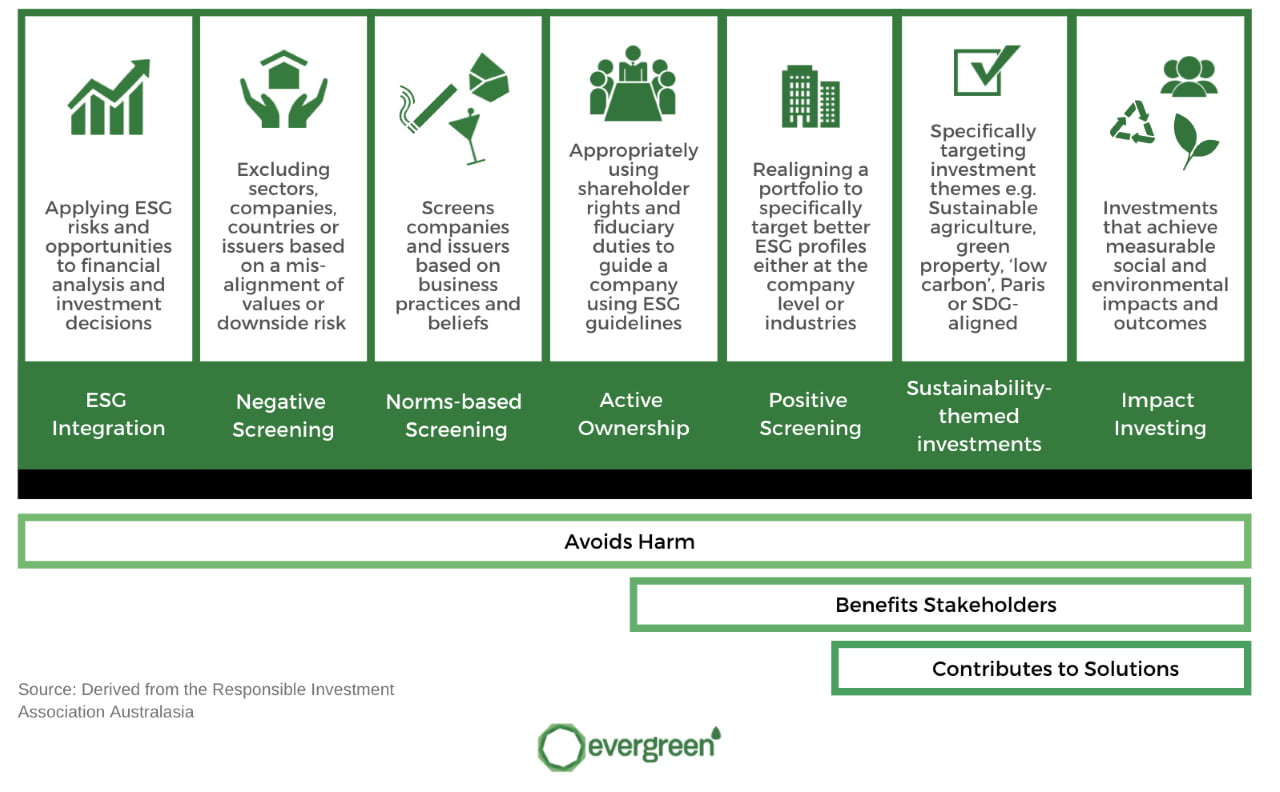

The ERIG Index was built to assign Responsible Investment ratings to managed funds,

providing Financial Advisers with a tool to build the perfect RI portfolio for your clients.

Analyse a Portfolio

Apply the ERIG Index to your portfolio and see how it compares to client expectations as

well as peer and sector averages.

RI Client Questionnaire

A handy tool for Financial Advisers to facilitate RI conversations with clients.