Reflections on Cop28 as it relates to Responsible Investment Management Strategies

Evergreen Consultants

Introduction

Expectations for Cop28 (or the Conference) were low even before it began. Being held in the UAE Petrostate and administrated through a conflicted presidency[1] - led by an oil company CEO proven to have planned to use his role to strike new oil deals with attending nations[2] - there was a sour taste in the mouths of climate activists and ESG advocates around the world.

But what was achieved, what wasn’t, and how will it impact the period ahead for those of us in the investment management industry? We will begin with a short summary of key Conference outcomes, before relating back to insights for Responsible Investment Management and Strategies.

Summary of Outcomes

The Conferences ‘final text’ titled FCCC/PA/CMA/2023/L.17 Outcome of the First Global Stocktake[3], is considered the principal document for understanding the outcomes decided in the closing of the Conference. Here is where we can find the heavily scrutinised language which provides insights for what is expected of governments and institutions globally.

The final text begins with a reaffirmation of the Paris Agreement, in aiming to limit global average temperature increases to 1.5°C, while acknowledging that since the agreement, needs and expectations have not been met. The stocktake recognises that the science indicates a need for a 43% greenhouse gas emissions reduction by 2030 and 60% by 2035 when compared to 2019 levels in order to meet the 1.5°C target alongside net zero carbon dioxide emissions by 2050. The framework for how this should be achieved, and the subjects of most deliberation during the conference itself, are separated into two key sections: Mitigation and Adaptation[4].

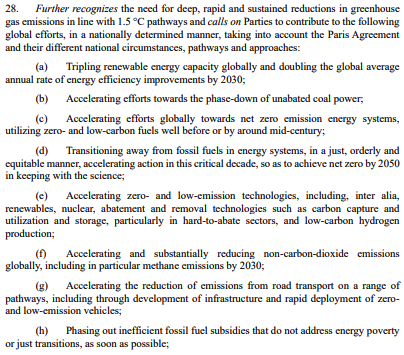

What has drawn most attention was the addition of point 28 under ‘Mitigation’:

Outcome of the first global stocktake, Page 5

Aside from the needed increase in renewable energy capacity and phasing out of inefficient fossil fuel subsidies, of particular note is the fact that this section expressly identifies, for the first time in the Conference’s history, that fossil fuels, and particularly coal, are to be necessarily transitioned away from. Optimists consider the inclusion of such language a win for the environment, marking a significant shift in the world’s consensus that fossil fuels require a phase-down. Pessimists (or perhaps realists) would have preferred “phase-out”, to “phase-down”, while drawing immediate concern over the use of the word “unabated” in section D. The use of this world effectively implies that the continued burning of fossil fuels, including increasing the capacity for such, would be acceptable if emissions are offset.

Over the length of the Conference, it was unsurprisingly clear that most nations intend on continuing to burn fossil fuels, pointing toward Carbon Capture and Storage (CCS), as a solution for enabling such. It is also clear that capacity for extracting fossil fuels in many places is likely to increase, which will require further CCS.

Shortly before the Conference began, the Oxford Smith School of Enterprise and the Environment launched an assessment on the relative costs of high-CCS and low-CCS pathways to 1.5 degrees. The study provided two scenarios – a high-CCS pathway, and a low-CCS pathway where CCS costs for reaching net zero by 2050 were calculated. It found that there has been no evidence for cost reductions in any part of the CCS process, including capture, transport and storage. Further, the current build rate of CCS will require significant acceleration in order to meet requirements even in the Low-CCS pathway. Finally, taking a Low-CCS pathway to net zero emissions “will cost at least US$30 trillion less than taking a High-CCS route – saving approximately a trillion dollars per year”. Thepaper urged governments to “rapidly” scale up CCS but reserve it “only for essential use cases”[1].

In terms of alternative energy sources to coal and oil, the paper called for a tripling in renewable energy capacity globally by 2030. Interestingly, a recognition that “transitional fuels can play a role in facilitating the energy transition while ensuring energy security” was also included. Liquified Natural Gas is considered a transitional fuel and is likely to see a boom in capacity over the coming period.

Relations to Responsible Investment Management and Strategies

Evergreen’s primary takeaway from Cop28 as it relates to Responsible Investment (RI), is that both exclusionary and inclusionary investment strategies will play central and long-term roles in achieving environmental, social and governance (ESG) outcomes. Both have significant addressable opportunities and markets for doing so.

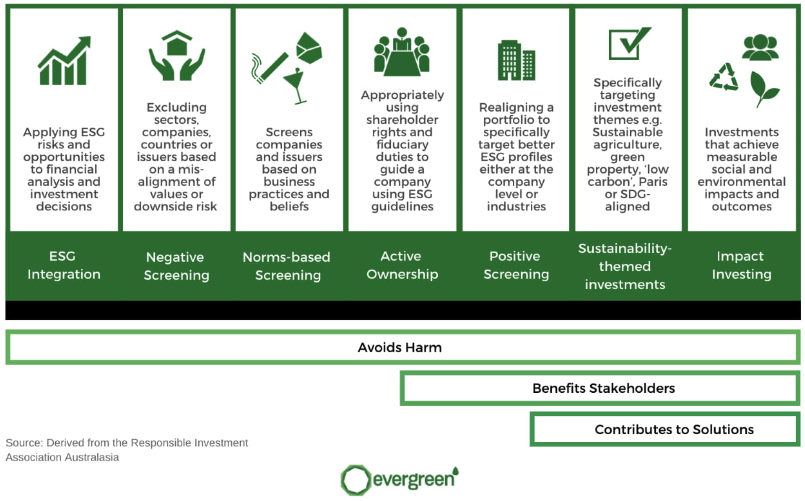

Evergreen, RIAA, Responsible Investment Spectrum

Evergreen and the Evergreen Responsible Investment Grade (ERIG) Index evaluate investment managers across 7 approaches to RI shown above. Across these approaches to funds management, managers – depending on their investment philosophies – may integrate both exclusionary and/or inclusionary processes. Some categories, such as negative screening and norms-based screening, lend themselves more directly to an exclusionary approach, while active ownership, sustainability-themed and impact investing are closely related to inclusionary approaches. However, across approaches, one can integrate both. For example, an equity manager could integrate best-in-class screens in order to invest in fossil fuels companies that, for example, might show a stronger propensity for CCS, or that despite their involvement in fossil fuel extraction, are invested also in accelerating renewable energy implementation and development. Here, despite having exposure to ‘ESG-negative’ sectors, their underlying exposures are contributing to positive ESG outcomes.This is in fact a boon for clients who desire ESG-conscious investment portfolios. Evergreen has found in the past that strategies which focus principally on one of an exclusionary or inclusionary approach are led into strong underlying factor biases. An example of this could be equity managers who remove fossil fuels from their investment universe, while being led heavily into technology and healthcare stocks, appearing starkly growth-biased over time due in part by their integration of RI, despite their portfolio construction and security selection processes.

By including managers that might take a more inclusionary approach to such sectors, one is able to increase diversification in a multi-manager, multi-asset class investment portfolio. This idea applies not only to equities, but also other asset classes such as fixed interest, property and indeed infrastructure. With clients who desire purpose-built ESG investment portfolios, it is Evergreen’s philosophy that a combination of managers who integrate both exclusionary and inclusionary practices is key in meeting long-term investment objectives and ensuring the sustainability of returns. Indeed, a given manager themselves may integrate both approaches at the fund level, also.

By utilising the ERIG Index, investors and asset allocators are able to understand how and where an investment manager integrates both exclusionary and inclusionary strategies, empowering them to construct better, more diversified portfolios.

Summary

Regardless of one’s opinions on Cop28, it is clear that the world is transitioning to one with lower carbon emissions, despite the potential for continued use of fossil fuels. In this world, investment strategies which can successfully integrate both exclusionary and inclusionary approaches to ESG analysis and security selection are relevant for ESG-focused investors. The identification of companies which will contribute to both or either of climate mitigation or adaptation will be key in deriving investment returns while achieving ESG outcomes. Both inclusionary and exclusionary approaches to RI will have significant opportunity sets as our species navigates environmental challenges, and both can be utilised in tandem.

[1] Carrington, D 2023, ‘“Absolute scandal”: UAE state oil firm able to read Cop28 climate summit emails’, The Guardian, 7 June. https://www.theguardian.com/environment/2023/jun/07/uae-oil-firm-cop28-climate-summit-emails-sultan-al-jaber-adnoc

[2] Stockton, B 2023, COP28 president secretly used climate summit role to push oil trade with foreign government officials, 27 November, Centre for Climate Reporting. https://climate-reporting.org/cop28-president-oil-climate/

[3] ‘Outcome of the first global stocktake ’ 2023, in Conference of the Parties serving as the meeting of the Parties to the Paris Agreement, United Nations Framework Convention on Climate Change. https://unfccc.int/sites/default/files/resource/cma2023_L17_adv.pdf

[4] The Intergovernmental Panel on Climate Change (IPCC) use the following definitions for Mitigation and Adaptation:

Mitigation: An anthropogenic intervention to reduce the sources or enhance the sinks of greenhouse gases.

Adaptation: Adjustment in natural or human systems in response to actual or expected climatic stimuli or their effects, which moderates harm or exploits beneficial opportunities.

[5] Bacilieri, A, Black, R & Way, R 2023, Assessing the relative costs of high-CCS and low-CCS pathways to 1.5 degrees, 4 December, Oxford Smith School of Enterprise and the Environment, <https://www.smithschool.ox.ac.uk/sites/default/files/2023-12/Assessing-the-relative-costs-of-high-CCS-and-low-CCS-pathways-to-1-5-degrees.pdf>.