Explainer Series: What is active ownership?

Schroders

In the debate over whether investors can encourage a more sustainable recovery, the role of active ownership is key.

Active ownership involves fund managers engaging with the companies they have invested in on behalf of their clients, to influence corporate behaviour around long-term sustainability issues such as climate change.

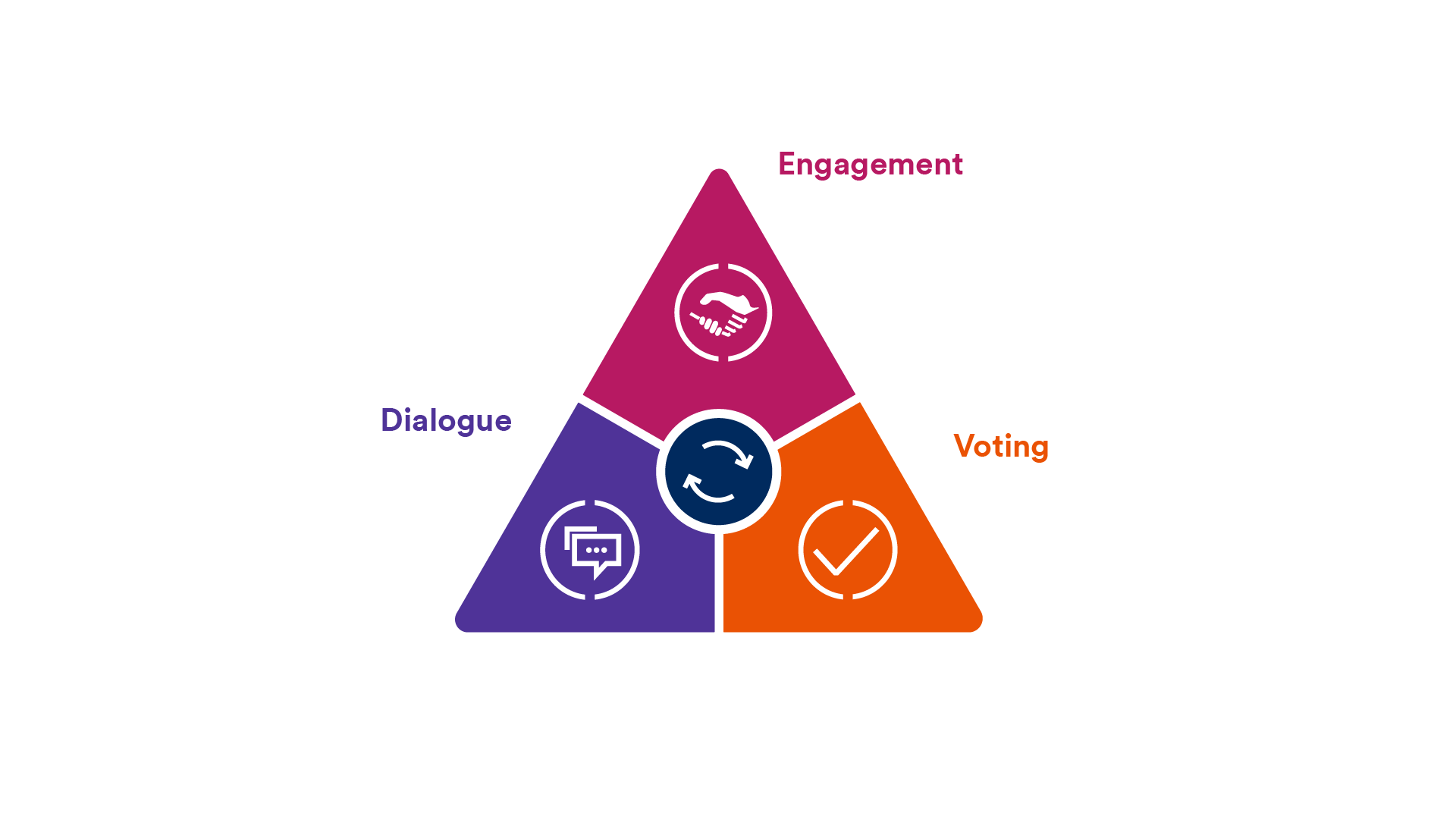

There are three key methods for practicing active ownership:

- Dialogue: Fund managers speak with companies to understand if and how they are preparing for the long-term sustainability challenges they face, such as climate change.

- Engagement: Fund managers work with companies to help them to recognise the potential impact of these challenges and to help them act in the areas where change may be required

- Voting: Fund managers use their voice and rights as shareholders to make sure these changes are implemented.

How do active fund managers engage with companies?

There are several different methods of engagement, such as meeting with company management and specialists over specific issues by going on site visits, joining investor meetings and organising proprietary events (for example, to engage with non-executive directors about research processes).

Prioritisation of engagement is generally process-driven - for example, a drop in a company’s Environmental, Social and Governance (ESG) rating; explaining where they’ve voted against management; or it could be driven by investment research. Examples of areas of thematic sustainability research includes the themes of plastics, sugar and climate change.

Effective engagement requires continuous monitoring and ongoing dialogue. When there have been repeated engagements, but no meaningful progress made by a company, fund managers can escalate their concerns. Decisions on whether and how to escalate are based on the significance of each issue, its urgency, the extent of the fund managers’ concern and whether the company has demonstrated progress through previous engagements.

Ways to escalate concerns can include voting against management; for example, by holding directors to account on ESG topics, and supporting shareholder proposals, which are becoming increasingly frequent and important levers for change. Fund managers can oppose management if they believe that doing so is in the best interests of shareholders and their clients.

Why is it important to have dialogue with companies over their Net Zero transition plans?

Today, you will be hard pressed to find examples of companies without a net zero by 2050 goal. In a nutshell, it is important to continually check in on whether businesses are cutting emissions by as much as possible, as soon as possible, and are being transparent about it.

It is also important to understand if the company is managing the social impacts of a rapid transition on its workers, communities, suppliers, and consumers.

Climate scientists have said the world needs to reach net zero by the middle of the century, and according to the United Nations more than 130 countries have set or are considering a net zero by 2050 goal. More than 2,000 businesses and institutions are working with the Science Based Targets initiative, which promotes best practice, to reduce their emissions in line with climate science.

Challenges to understanding the credibility of net zero goals are numerous, however. They include varying definitions and use of language (think ‘carbon neutral’ vs ‘carbon-free’), questionable use of offsets and the absence of interim targets. It is crucial that fund managers understand the nuances.

This is not only important in the fight against climate change – it is also about profits. As an asset management business, Schroders’ aim is to provide excellent investment performance for our clients by seeking out companies with sustainable and robust business models.

It can also be beneficial to work with other asset management peers to combine percentage holdings in a company where that company has not responded to investors’ nudges. With a collective voice, it is easier to influence a company or encourage them to provide more disclosure.

Through constructive and committed engagement with management teams at companies, active ownership is a key element of the value that can be brought to clients. Social and environmental forces are reshaping societies, economies, industries, and financial markets. Approached thoughtfully and with focus, encouraging management teams to adapt to those changes, and holding them accountable for doing so, can strengthen the long-term competitiveness and value of those assets and can accelerate positive change towards a fairer and more sustainable global economy.